Step One: To Make Clear the Subject Timber Scientific Classification

A specific timber may have various names including name of the tree species, commodity name and scientific name. In addition, different countries may have different names for a specific timber. It is no wonder that some different names are actually for a same timber. The most accurate name for a timber is its scientific name in Latin Language.

Classification by Processing Stage

Logs refer to wood cut to standard size after

Fell Trees after being removed branch and leaves are cut to wood blocks that meets standard requirements. The wood blocks are what we called logs.

Converted timber refers to wood materials produced after logs are sawn, peeled, sliced, rotary-cut and/or other machine processing. Converted timber include wood beams, planks and wood chips but not include wood waste like Wood scraps, wood pellets, wood saw dusts and wood-wool

Step 2: Quarantine Risk for Imported PlantsThe Main Varieties of Pests

wood-boring insects, mollusk, nematode, fungus, bacteria

The Keys of Inspections

1.Whether the imported timber carries soil

2.Whether the imported timber has bark?

3.Whether the imported timber comes with phytosanitary officially issued by the exporting country or region.

Imported logs with bark shall be effectively quarantine treated in the exporting country or region. The detailed treatments shall be remarked on the phytosanitary certificate.

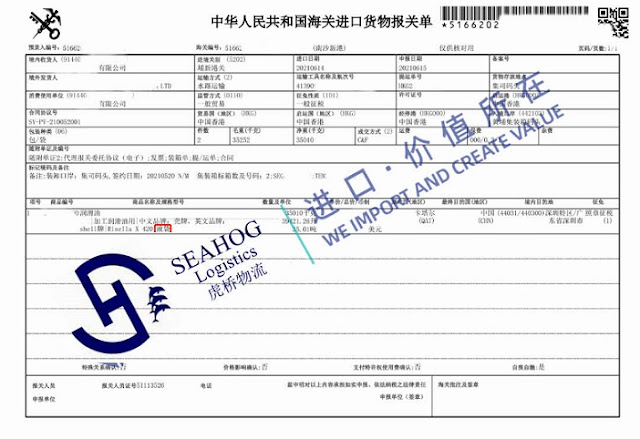

Step 3: The Import Flow China Customs Declaration

1.Basic info name, variety, processing method, dimensions of cross section, length, specification, grade, whether blue stain, whether drying, whether with bark.

2.Document preparations: the importer or their China customs agent shall declare to animal and plant quarantine department of the port of entry with phytosanitary certificate officially issued by the exporting country/region and sales contract and other documents before/when the fauna and flora, fauna and flora products and other quarantine items arrive in China.

Tips:

Timber that has volume quantity requirements shall be scale measured and provide scaling note.

Timber protected by CITES shall provide CITES Permit for Import & Export or Certificate for Non-Regulated Species Listed in the HS Commodity Appendix of Import & Export on Wild Fauna & Flora. Representative wood blocks shall be cut and sent to laboratory for identification.

Quarantine

On-Field Quarantine

1.Check the goods and the documents

2.Targeted Examination: Based on the epidemic of the exporting country/region and our country’s quarantine required and the fact that different wood species may carry pests and the biological characteristics of the pests, the targeted examination will be carried out.

3.Sampling: representative wood blocks or bark on which pests or suspicious symptoms

are found will be sent to laboratory for further identification

Laboratory Quarantine

The laboratory does quarantine identification on the submitted samples.

Disposal live quarantine pests or other live pets with quarantine pests are found and the pests might spread, the below measures shall be taken

1.If there are no effective quarantine treatment methods, the shipment will be returned or destroyed

2.If there are effective quarantine treatment methods, China customs shall supervise the implementation of the quarantine treatments.

Step 4: the Follow-up of Import Ban & Limit Control. From Feb 1, 2022, appointed port entry management method has been implemented for imported Pinus spp. (including logs and converted timber) from epidemic areas of Bursaphelenchus xylophilus. For example, in the jurisdiction of Guangzhou Customs, San Shan port of FoShan is the appointed port to imported pine wood from countries that epidemic of Bursaphelenchus xylophilus is happening. In case that imported pine wood is found carrying live Bursaphelenchus xylophilus or longicorn, the shipment shall be returned or destroyed. CGAC will report in time to the plant quarantine department of the exporting country/region and will pause the importation of Pinus spp from the relevant enterprises and producing areas. The epidemic areas of Bursaphelenchus xylophilus include Canada, Japan, Korea, Mexico, Portugal, Spain and USA.

Logs of Fraxinus are prohibited from importing from countries and regions where Fraxinus dieback is happening.

coniferous wood of Virginia/South Carolina USA origin are banned from importing.

--- --- --- --- --- --- --- ---

Seahog Logistics-Since 1997

China customs broker, China Import Agent, Freight Forwarder, Door to Door Solutions

Contact:Ms Mabel

Mobile/whatsapp:+86-137-6070-0701

Email: 308704459@qq.com

Skype: rosehill-yh

QQ/WeChat: 308704459

Website: http://www.seahog-aw.com/