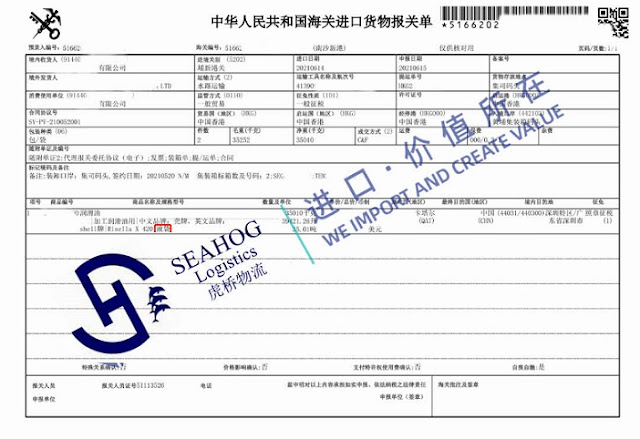

Shipment 2 & 3, lubricating oil, also originated from Qatar, packed in Flexitanks, was cleared by SeaHog's Guangzhou customs clearance agent team at Guangzhou Huangpu port.

The China Customs Declaration Flow of Lubricating oil1.Ask China customs clearance agency company review the required documents for handling customs clearance in China

2.Arrange shipping to China

3.Exchange D/O after shipment arrival

4.CIQ & Customs Declaration

5.Arrange tax payment to China customs. The import duty(tariff) will be different because of the applied conventional rate, MFN RATE or prefered rate. The value added tax is 13%, not matter the oil is from any country. The consumption tax is RMB1.52/liter.

6.Customs inspection

7.Customs release

8.Pick up the shipment and arrange delivery

Notes

1.Before declaration, it is very important to make sure the goods is lubricating oil (lube) or lubricant whose biggest different the mineral oil content. lubricating oil (lube) contains more than and equal to 70% of mineral content, while lubricant’s mineral oil content is less than 70%. The HS codes for lubricating oil (lube) and lubricant are different. China customs will collect consumption tax from lubricating oil (lube), and there is no consumption tax for lubricant.

2.Before shipping, samples shall be provided to do testing so as to obtain identification report for non-hazardous goods. Some ports require this report for customs clearance.

3.Chinese MSDS shall be prepared before shipment arrival.

4.Lubricating oil (lube) contained in tanks shall provide tank certificate.

--- --- --- ---

Seahog Logistics- Since 1997

Shenzhen customs broker, Shenzhen Import Agent, Freight Forwarder, Door to Door Solutions

Contact:Ms Mabel

Mobile/whatsapp:+86-137-6070-0701

Email: 308704459@qq.com

Skype: rosehill-yh

QQ/WeChat: 308704459

Website: http://www.seahog-aw.com/

No comments:

Post a Comment